How I retired at age X (a lady never tells her age)

I have several people to thank for my early retirement - of course, my parents, for making me think we were poor by only letting me order tap water to drink at restaurants, which we very rarely frequented, and forcing me to save 50% of my income, starting at age 11, for college.

I also need to thank 12-year-old me, for the generally impractical choice of studying French instead of Spanish (because middle school me would rather visit France than Spain- somehow did not consider Mexico, where ironically I now own a house…). However, in global public health, French has proven to be my competitive edge and launched my expat career where housing expenses are paid and you live in countries where there is nowhere to spend your money anyways.

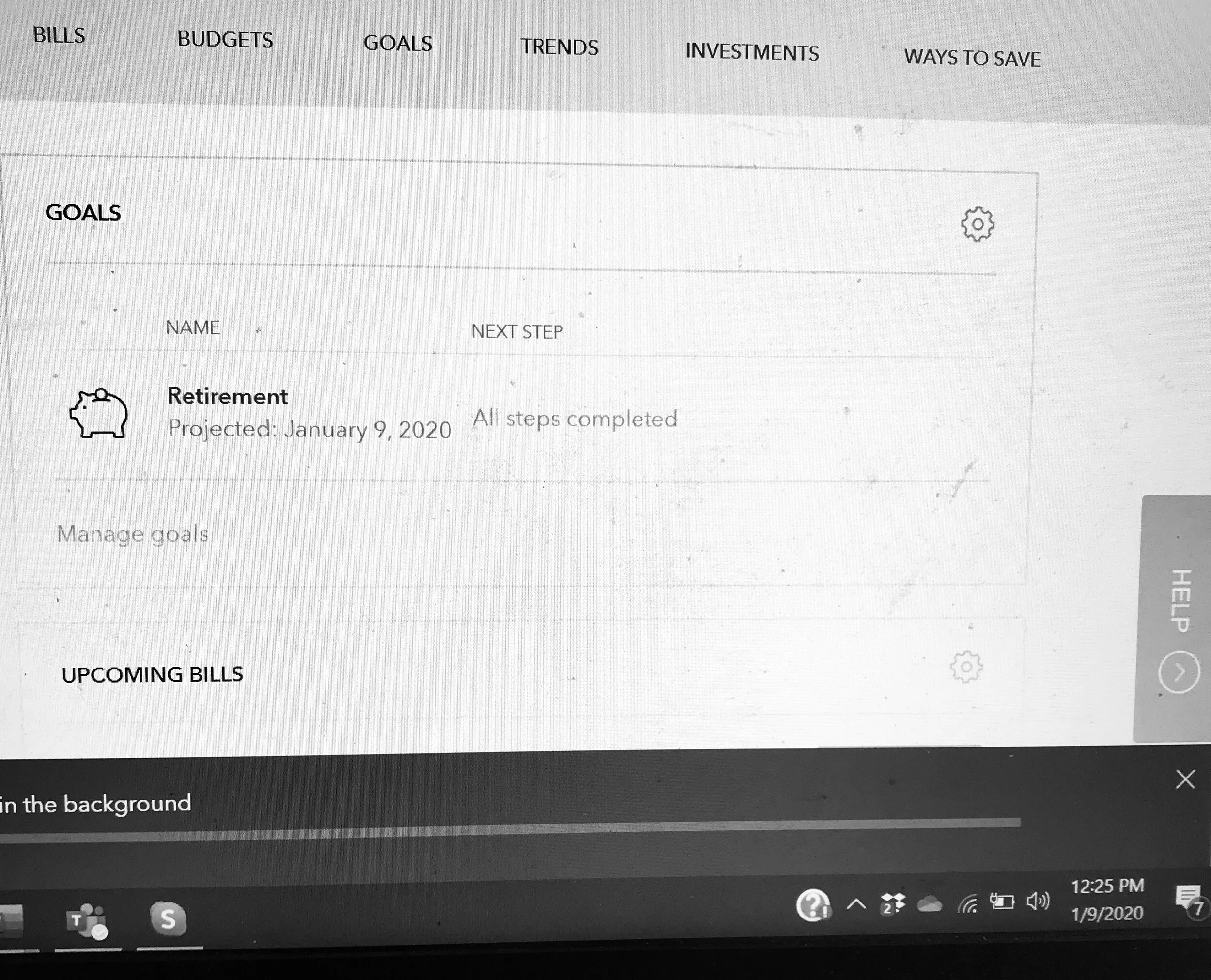

Mint says I can retire today.

I found out about FIRE (financial independence- retire early) when I was 30, living back in the States for the first time in four years. Frugalwoods was my introduction and continues to be my inspiration, and from there I found Mr. Money Mustache for the more nuts and bolts and general spend-shaming. Turns out I was accidentally on the path to early retirement due to my inherited cheapness and nomadic expat lifestyle. There are lots of ways to do this and plenty of blogs documenting how; my path is probably one of the least typical. My top tricks for achieving early retirement, from easiest to most difficult, are:

Eat less meat

Some might think this is hard, and I did too until I was living in rural India and there was no meat and I was just fine. I’ve been mostly vegetarian for 10+ years, dabbling in veganism and these days eating some seafood (fairly close to the Brain Food recommended diet, which I like because she says I can drink wine every day). However you feel about animals - personally, I don’t care for them - eating meat isn’t great for you, it’s pretty terrible for the environment, and it is probably the most expensive item in your shopping cart (assuming, like me, you drink cheap wine).

Move every 2 years with just 2 checked suitcases

I hate paying to check bags. And shipping stuff is a pain. So every two years when, as expats do, we move to a new continent, it’s time to downsize. I look at what I have, see what I can’t get where I am going, Marie Kondo my wardrobe, see what will fit into my luggage allowance for the plane, then give away/throw away/sell the rest. I’ve done these moves as a single person, as a couple with four suitcases, and with six as a family with a baby/toddler. My next big challenge will be to do it with a four-year-old with hoarding tendencies and an elephant’s memory.

Even that little one never forgets…

3. Practice Geo-arbitrage

My daughter was born in the US, and as soon as we got her passports we packed those six suitcases (one was actually a cardboard box) and moved to Mexico. It was better financially for me to be unemployed in Mexico than working and paying for infant child care in Washington DC. In the end, I was able to work remotely, which gave me the ideal situation of earning a US salary while having Mexican expenses.

Developing countries have lower costs not just for child care but also for food (if you eat like a local) and don’t even get me started on health care. I’ve been to Thai hospitals with someone playing a grand piano in the waiting room that cost less than my co-pay in the US.

It is also hard to spend money on stuff - I’ve lived in several countries where there are no malls, and truly the best way to know if you really need something is to have to ask a work acquaintance to mule your Amazon purchases halfway around the world for you. Plus, you can’t have too much stuff if you are going to fit it all into your two suitcase allowance when you move again in a few years.

4. Build a house with cash

Doing all of the above, and having a partner who also does 2/3 of the above, gave us enough savings to buy some land in Mexico from a relative. We saved some more and then started to build our forever home, with two apartments attached to it so we could make some income since we weren’t sure what we would be doing for work in Mexico. Thanks to Home Depot Mexico’s ‘Meses sin Intereses’ credit card, and buying everything during sales, we were able to finish the house in two years and keep paying off the materials and appliances for an additional 18 months with no interest, while the house and apartments were earning money on Airbnb. Why was our house also on Airbnb, you might ask? Because true to form, after two years in Mexico, where we were supposed to stay forever, we moved for my partner’s startup to Tanzania. With six suitcases.

Now the house is making a profit that we in turn invest in index fund ETFs at Charles Schwab, along with the rest of our salaries we save each month. The apartments on Airbnb plus investment returns would cover our living costs if we retired to our forever house today. This amount is fairly low since the cost of living in Mexico is very cheap, plus we have no debt or rent to pay.

I do miss my forever house kitchen…

Bonus: Have your partner sell his startup for a lot of money

This was not in my plan, and I don’t think it should be for anyone. Over the years we have put some of our money and most of my partner’s time into starting a bunch of businesses in various countries, most of which have not panned out. He has worked extremely hard for no salary for most of that time. I’m very proud of him and what he has achieved, not just for monetary reasons but also because his work will improve the lives of millions of women across Africa- but I wanted to be sure that I took care of my own financial needs before I became a lady who lunches. Women who rely on their partner completely for covering their costs can be in a vulnerable position if their relationship changes, so I feel more secure - both financially and in my relationship - by knowing I can be fine on my own if needed.

This development has changed my early retirement plans, however. The original plan of going back to our forever home in Mexico doesn’t mesh with his new contract with the company that bought his startup. So next stop…China.